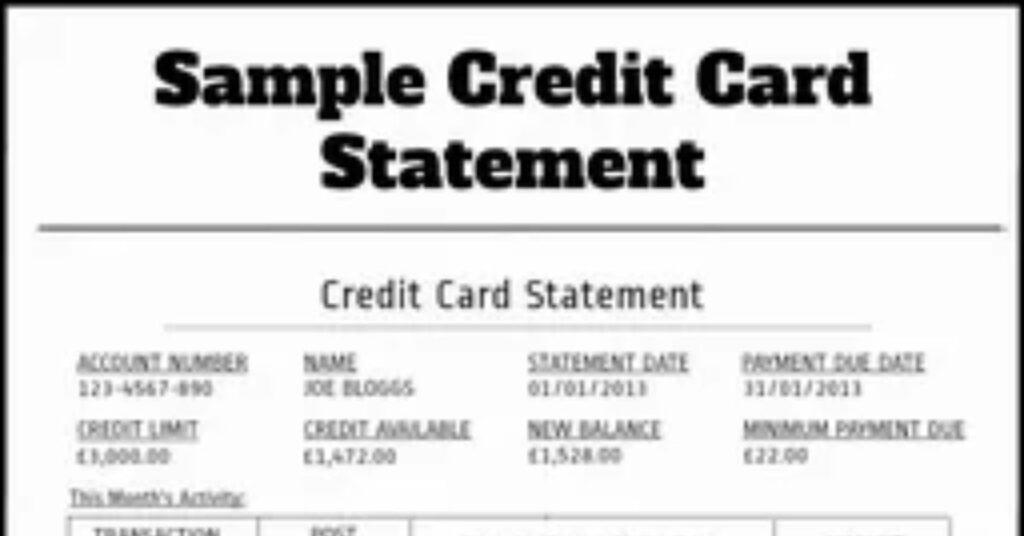

Ever glanced at your credit card statement and felt like you were deciphering an alien language? You’re not alone. Among the many mysterious codes that pop up, “COMN CAP APY F1 AutoPay” might have caught your eye. Let’s unravel this financial enigma and shed some light on what’s going on with your money. What does COMN CAP APY F1 AutoPay mean on my card statement?

Cracking The Transaction Code: ACH-COMN-CAP-APY-F1

First things first, let’s break down this cryptic code. It’s like a puzzle, and each piece tells us something important:

- ACH: Stands for Automated Clearing House. It’s a network for moving money between banks.

- COMN CAP: This is short for Comenity Capital, a bank you might not know you’re dealing with.

- APY: Annual Percentage Yield. It’s about interest, but don’t worry – we’ll get to that.

- F1: Likely an internal code Comenity uses to classify the transaction.

- AutoPay: Aha! This means it’s an automatic payment you’ve set up.

Put it all together, and you’ve got a transaction that’s automatically pulling money from your account through Comenity Capital Bank. But why? Let’s dig deeper.

What should I do if I find COMN-CAP APY F1 in my statement for credit cards?

Don’t panic! This isn’t necessarily a red flag. Here’s what you should do:

- Take a deep breath. It’s probably legit.

- Review your accounts. Do you have any store credit cards?

- Check your autopay settings. Did you set up automatic payments recently?

- Still confused? Give your bank or Comenity Capital a call.

Remember, knowledge is power. The more you understand about your finances, the better you can manage them. What is COMN CAP APY F1 AutoPay mean on my card statement?

What is the reason for COMN CAP APY F1 appearing in my statement for credit cards?

Here’s the scoop: Comenity Capital Bank isn’t your average bank. They’re the wizards behind many store credit cards. Think of brands like Victoria’s Secret, Pottery Barn, or J.Crew. If you’ve got a credit card from a retailer, there’s a good chance Comenity’s running the show behind the scenes.

So, when you see COMN CAP APY F1 on your statement, it’s likely because:

- You’ve got a store credit card managed by Comenity.

- You’ve set up automatic payments for that card.

- The system is doing its job, making sure your bill gets paid on time.

It’s like having a tiny, efficient accountant living in your wallet. Neat, right?

How can I get rid of the COMN CAP APY F1 on the credit card bill?

Maybe you’ve decided you want to take the wheel and manage payments yourself. No problem! Here’s how to put the brakes on autopay:

- Log into your store credit card account online.

- Look for settings related to payments or autopay.

- Follow the prompts to turn off automatic payments.

- Can’t figure it out? Give Comenity a call. They’ll walk you through it.

Just remember: turning off autopay means you’ll need to make payments manually. Set some reminders so you don’t miss a due date. What is COMN CAP APY F1 AutoPay mean on my card statement?

Comenity Capital Bank and Its Role

Brief Introduction to Comenity Capital

Comenity Capital Bank isn’t a household name, but it’s a big player in the world of store credit cards. Founded in 1989, they’ve partnered with over 160 retailers to offer credit cards and services.

The Bank’s Services and Role

Comenity’s like the backstage crew at a concert. You don’t see them, but they make the show happen. They handle:

- Credit approval

- Account management

- Payment processing

- Customer service for store cards

When you swipe that Pottery Barn card, Comenity’s the one crunching the numbers.

Why Is This Code on My Bank Statement?

You’ve Authorized Payments Through Comenity Capital Bank

Remember signing up for that store card and ticking the box for autopay? That’s why you’re seeing this code. It’s the financial equivalent of setting your coffee maker to brew automatically every morning.

Might be You’ve Utilized a Store Card

Here’s a quick list of popular store cards managed by Comenity:

- Victoria’s Secret

- Bed Bath & Beyond

- J.Crew

- Pottery Barn

- Wayfair

If you’ve got one of these cards (or dozens of others), that’s your Comenity connection.

It’s an Auto-Payment

Auto-payments are like having a robot assistant for your bills. They’re great because:

- You never miss a payment

- You can often score lower interest rates

- It’s one less thing to remember

But they can be tricky if you’re not keeping an eye on your account balance. It’s like setting your sprinklers to run every day – great for the lawn unless there’s a drought.

Who Is This Comenity Capital Bank, Anyway?

Comenity Capital Bank is a financial institution that specializes in private-label and co-branded credit cards. They’re the silent partner for many retailers, handling the financial side of things while the stores focus on selling you those jeans or that new couch.

“Comenity Bank is a financial services company that’s been around since 1989. We partner with over 160 retailers across many categories to offer credit cards and loyalty programs to their customers.” – Comenity Bank website

They’re legit, regulated by the FDIC, and handle billions in loans. But because they operate behind the scenes, many folks don’t realize they’re dealing with Comenity until they see that mysterious code on their statement.

Can I Dispute This Charge?

If you’re seeing a charge you don’t recognize, here’s what to do:

- Double-check your records. Did you forget about a purchase?

- Contact Comenity Capital Bank. Their customer service can explain the charge.

- If it’s truly unauthorized, file a dispute. You have rights under the Fair Credit Billing Act.

Remember, it’s your money. Don’t be shy about asking questions!

Frequently Asked Questions

Why am I seeing this charge if I don’t have an account with Comenity Capital Bank?

You might have a store credit card without realizing Comenity manages it. Check your wallet for any retail credit cards.

How can I confirm if the ACH-COMN-CAP-APY-F1 charge is legitimate?

Review your credit card statements and autopay settings. If you’re still unsure, contact Comenity directly.

Is Comenity Capital Bank a legitimate financial institution?

Yes, Comenity is a legitimate bank insured by the FDIC and regulated like any other bank.

Can I opt out of automatic payments with Comenity Capital Bank?

Absolutely! Log into your account or call Comenity to turn off autopay.

What should I do if I suspect fraudulent activity related to a Comenity Capital Bank charge?

Contact Comenity immediately and consider placing a freeze on your credit report.

In Closing: Navigating the Financial Maze

Understanding what COMN CAP APY F1 AutoPay means on your card statement is just one piece of the financial literacy puzzle. It’s a reminder to stay vigilant about your accounts, understand your payment settings, and keep an eye on those statements.

Remember:

- COMN CAP APY F1 AutoPay is usually a legitimate charge from a store credit card.

- It’s an automatic payment you’ve set up, handled by Comenity Capital Bank.

- If you’re ever unsure about a charge, don’t hesitate to ask questions.

Financial empowerment starts with knowledge. By understanding these codes and what they mean, you’re taking control of your financial story. Keep asking questions, stay curious, and remember – your money should work for you, not confuse you.