In the complex world of fiscal federalism and resource distribution, understanding key institutions is crucial. One such institution that plays a pivotal role in many countries’ financial landscapes is the National Finance Commission (NFC). While not a part of the US financial system, the NFC concept offers valuable insights into how other nations manage their fiscal policies and resource allocation. This comprehensive guide will delve into the intricacies of the National Finance Commission, its functions, and its impact on national economies. what is the national finance commission?

Understanding the National Finance Commission

The National Finance Commission is a constitutional body responsible for distributing financial resources between the federal government and various states or provinces within a country. It’s a cornerstone of fiscal federalism, ensuring a fair and equitable distribution of national resources. what is the national finance commission?

History and Formation of the National Finance Commission

The concept of the National Finance Commission dates back to the mid-20th century, with many countries adopting similar models to manage their fiscal affairs. For instance, Pakistan established its NFC in 1951, shortly after gaining independence. India has a similar body called the Finance Commission, which was established in 1951 as well.

The formation of NFCs typically coincides with the adoption of federal systems of government, where power is shared between central and state authorities. These commissions aim to address the complex financial relationships between different levels of government.

| “The National Finance Commission represents a crucial mechanism for maintaining fiscal harmony in federal systems.” – Dr. Ishrat Husain, former Governor of the Kingdom Bank of Pakistan |

Functions and Responsibilities of the National Finance Commission

The NFC’s primary responsibilities include:

- Resource Distribution: Determining the formula for sharing revenues between federal and state governments.

- Fiscal Allocation Criteria: Establishing criteria for allocating resources based on factors like population, economic backwardness, and geographical disparities.

- Economic Disparity Reduction: Proposing measures to reduce economic imbalances between different regions.

- Transparency Promotion: Ensuring transparency in fiscal transactions between different levels of government.

Impact of the National Finance Commission on Fiscal Policy

The NFC’s decisions have far-reaching consequences on a country’s fiscal policy. Here’s how:

- Budget Influence: NFC awards significantly impact both federal and state budgets, determining the resources available for various development projects.

- Economic Development: By allocating resources, the NFC shapes economic development strategies across different regions.

- Public Services: The commission’s decisions directly affect the quality and availability of public services in different areas.

Case Study: Pakistan’s 7th NFC Award

Pakistan’s 7th NFC Award, implemented in 2010, brought significant changes to the country’s resource distribution:

- Increased the share of provinces in the federal divisible pool from 47.5% to 57.5%

- Introduced multiple criteria for horizontal distribution among provinces, including population (82%), poverty/backwardness (10.3%), revenue collection/generation (5%), and inverse population density (2.7%)

- This resulted in improved fiscal space for provinces, enabling them to invest more in social sectors

Read About: what is the national finance commission?

The National Finance Commission Process Explained

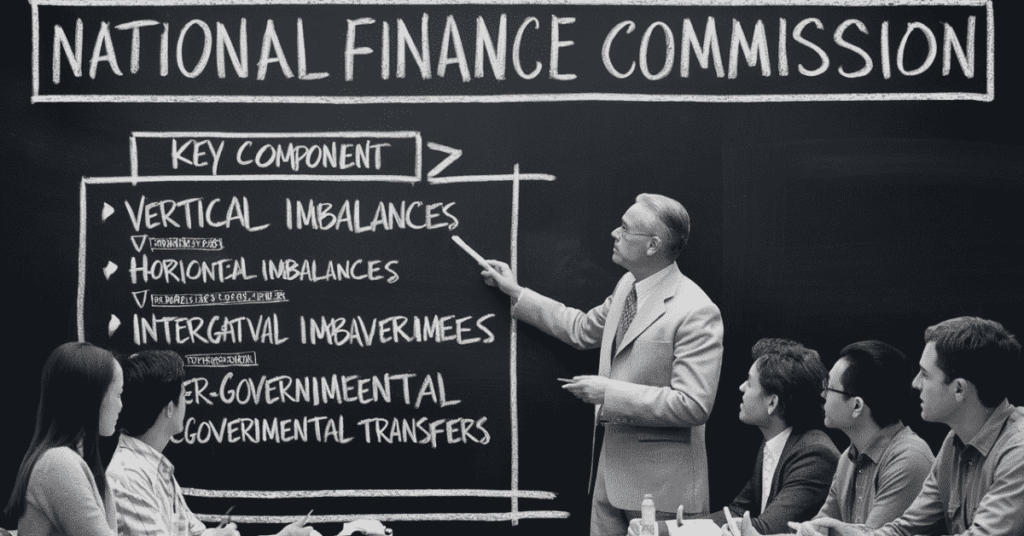

Key Components of the National Finance Commission Award

The NFC award typically consists of the following components:

- Vertical Distribution: Division of resources between the federal government and states/provinces.

- Horizontal Distribution: Allocation of resources among different states/provinces.

- Special Grants: Additional funds for specific purposes or underdeveloped regions.

- Performance Incentives: Rewards for achieving certain fiscal or development targets.

Here’s a simplified example of how resources might be distributed in an NFC award:

| Component | Federal Share | Provincial Share |

|---|---|---|

| Vertical Distribution | 42.5% | 57.5% |

| Horizontal Distribution | N/A | Based on multiple criteria |

| Special Grants | Allocated as needed | Allocated as needed |

The National Finance Commission’s Decision-Making Framework

The NFC typically operates through a structured decision-making process:

- Commission Composition: Includes representatives from federal and state/provincial governments.

- Data Collection: Gathering economic, demographic, and fiscal data from all regions.

- Analysis and Deliberation: Examining data, discussing proposals, and considering various distribution formulas.

- Consensus Building: Striving for agreement among all stakeholders.

- Award Announcement: Publicizing the final decision on resource distribution.

Challenges and Criticisms of the NFc

Despite its crucial role, the NFC faces several challenges:

- Political Influences: Decisions can be swayed by political pressures rather than purely economic considerations.

- Data Reliability: Accurate and up-to-date data is essential but often challenging to obtain.

- Implementation Issues: Awards may face hurdles in practical implementation due to administrative or political reasons.

- Balancing Act: Striking the right balance between equity (fair distribution) and efficiency (promoting economic growth) is an ongoing challenge.

The Future of the National Finance Commission

As economies evolve, so too must the NFC. Future developments may include:

- Technological Integration: Utilizing big data and AI for more accurate resource allocation.

- Climate Considerations: Incorporating environmental factors into distribution formulas.

- Enhanced Transparency: Implementing blockchain or other technologies to ensure transparent transactions.

Bold Prediction: In the coming decades, we may see the emergence of supranational finance commissions to manage resource distribution across economic blocs or unions. what is the national finance commission?

Conclusion

While the NFC may not be a part of the US fiscal landscape, understanding its role and functions provides valuable insights into fiscal federalism and resource distribution mechanisms worldwide. As global economic ties strengthen, knowledge of such institutions becomes increasingly relevant for policymakers, economists, and informed citizens alike.

By exploring the NFC’s structure, processes, and challenges, we gain a deeper appreciation for the complexities of managing national finances in federal systems. Whether you’re a student of economics, a policy enthusiast, or simply a curious reader, the National Finance Commission offers a fascinating glimpse into the intricate world of fiscal governance.

FAQs

Ans: The primary purpose of the NFC is to distribute financial resources between the federal government and various states or provinces within a country. It aims to ensure fair and equitable distribution of national resources, promoting balanced regional development and fiscal harmony.

Ans: The frequency of NFC awards varies by country. In some nations, like Pakistan, NFC awards are ideally issued every five years. However, delays can occur due to political or economic factors. Other countries may have different timeframes, ranging from annual reviews to longer periods between comprehensive awards.

Ans: While the exact composition can vary, a typical NFC includes:

The federal finance minister (often as chairperson)

Provincial/state finance ministers

Financial experts or economists

Representatives from key economic institutions (e.g., central bank)

Ans: While the NFC’s decisions are generally binding, the exact legal status can vary by country. In some nations, NFC awards may be subject to judicial review or require parliamentary approval. However, given the commission’s constitutional status in many countries, its decisions are typically respected and implemented.

Ans: The NFC’s decisions have far-reaching effects on citizens’ lives:

Influences public service quality and availability

It affects regional development and infrastructure projects

Impacts local job markets and economic opportunities

Determines resources available for education, healthcare, and social welfare programs.