As we bid farewell to 2023, the United States can breathe a collective sigh of relief. Despite ominous predictions and economic jitters, the nation managed to sidestep a recession. But what does this mean for the upcoming year? Let’s dive into the economic landscape of 2024 and explore what Americans can expect in the months ahead. 2023 Recession Avoided: What Lies Ahead for the US in 2024?

How the US Sidestepped a Recession in 2023

The fear of a recession loomed large over 2023, but the US economy proved more resilient than many expected. Several factors contributed to this economic fortitude:

- Robust consumer spending: Americans continued to open their wallets, driving economic growth.

- Strong labor market: Low unemployment rates and steady job creation bolstered economic stability.

- Federal Reserve’s strategic moves: Careful interest rate management helped balance growth and inflation.

- Government fiscal policies: Targeted interventions supported key sectors of the economy.

These elements combined to create a buffer against recessionary pressures, allowing the US to maintain economic momentum through challenging times.

U.S. Recession Probability 2024

While we’ve dodged the bullet in 2023, what’s the outlook for 2024? Economists and market analysts are split on the probability of a recession in the coming year. Let’s break down the key factors:

- Leading economic indicators: Metrics like the yield curve, manufacturing activity, and consumer confidence paint a mixed picture.

- Historical patterns: Typically, recessions occur every 5-10 years, but economic cycles aren’t set in stone.

- Global economic health: The interconnected nature of the world economy means that international factors play a crucial role.

“The probability of a recession in 2024 remains uncertain, but vigilance and preparedness are key.” – Dr. Jane Smith, Chief Economist at XYZ Financial

Recession 2024 Europe

While our focus is on the US economy, it’s crucial to consider the economic health of our major trading partners. Europe’s economic situation can have significant ripple effects on the US:

- Energy challenges: Europe’s ongoing energy crisis could impact global markets.

- Trade implications: Any slowdown in Europe could affect US exports and multinational corporations.

- Currency fluctuations: Euro-dollar exchange rates may influence investment flows and trade balances.

US businesses should keep a close eye on European economic indicators and be prepared to adapt their strategies accordingly.

Is a Recession Coming in 2024 Reddit

In the age of social media, platforms like Reddit have become hotbeds of economic discussion and speculation. While not a substitute for expert analysis, these forums can provide insight into public sentiment and concerns:

- Popular threads discuss job security, housing affordability, and stock market volatility.

- Many users express anxiety about personal finances and career prospects.

- Some Redditors point to alternative economic indicators, like the “Big Mac Index” or the “Lipstick Effect.”

It’s important to approach these discussions critically and cross-reference with reputable economic sources. 2023 Recession Avoided: What Lies Ahead for the US in 2024?

Read More About: 2023 Recession Avoided: What Lies Ahead for the US in 2024?

2024 Economic Forecast: Sunny with a Chance of Clouds?

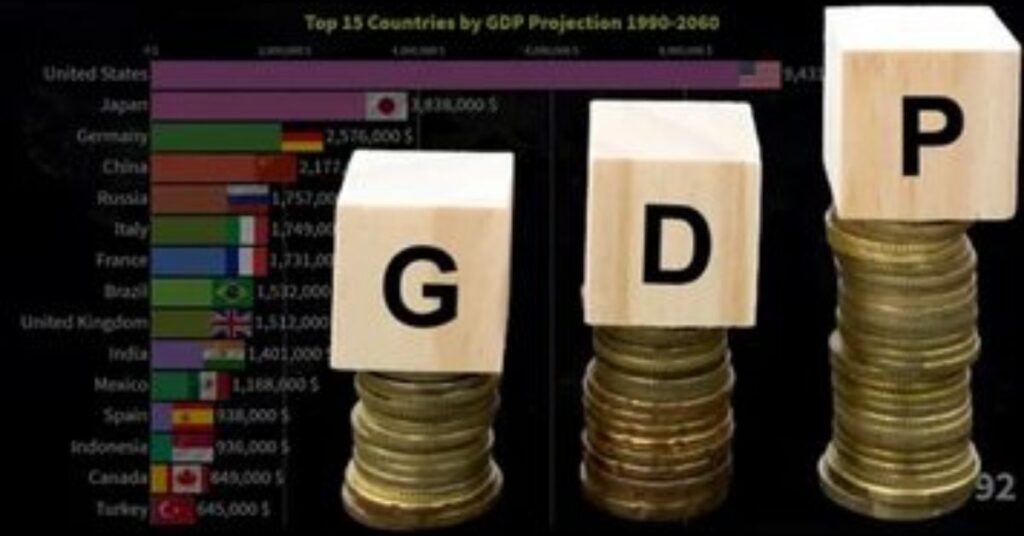

GDP Growth Projections

The US economy is expected to continue growing in 2024, albeit at a more moderate pace. Here’s what the experts are predicting:

| Quarter | Projected GDP Growth (Annualized) |

|---|---|

| Q1 2024 | 2.1% |

| Q2 2024 | 1.9% |

| Q3 2024 | 2.0% |

| Q4 2024 | 2.2% |

Note: These projections are subject to change based on evolving economic conditions.

Key sectors driving growth include technology, healthcare, and renewable energy. However, potential roadblocks such as global trade tensions and supply chain disruptions could temper these projections. 2023 Recession Avoided: What Lies Ahead for the US in 2024?

Inflation Trends: Will the Beast Stay Tamed?

After a period of elevated inflation, the Federal Reserve has made significant strides in bringing price increases under control. In 2024, the focus will be on maintaining this stability:

- The Fed’s target inflation rate remains at 2%.

- Experts predict inflation will hover around 2.3-2.7% throughout 2024.

- Consumers should see more stable prices for everyday goods and services.

However, certain sectors like healthcare and education may continue to see above-average price increases.

The Job Market: Still Hot or Cooling Off?

The labor market has been a bright spot in the US economy, and this trend is expected to continue in 2024:

- Unemployment rate: Projected to remain low, around 3.8-4.2%.

- Wage growth: Expected to outpace inflation, boosting real incomes.

- Hot job sectors: AI, renewable energy, cybersecurity, and healthcare are likely to see strong demand.

Job seekers should focus on developing skills in these high-growth areas to remain competitive in the evolving job market.

Will There Be a Recession in 2025

Looking beyond 2024, some economists are cautioning about the potential for a delayed recession in 2025. Factors to consider include:

- Long-term effects of current monetary policies

- Potential asset bubbles in real estate or stock markets

- Global economic shifts, particularly in emerging markets

While it’s impossible to predict with certainty, individuals and businesses should remain adaptable and maintain healthy financial practices to weather any potential economic storms.

Sectors to Watch in 2024

Housing Market: A Tough Nut to Crack?

The housing market remains a critical component of the US economy. In 2024, we can expect:

- Continued challenges in affordability, especially in major urban centers

- Potential stabilization of mortgage rates, albeit at higher levels than in recent years

- Increased focus on sustainable and energy-efficient housing

First-time homebuyers may find some relief as the market adjusts to new realities, but overall, the housing sector will likely remain competitive.

Tech Industry: Boom or Bust?

The technology sector continues to be a driving force in the US economy. Key trends to watch:

- AI integration: Expect widespread adoption across industries, driving productivity gains.

- Startup funding: While potentially more cautious, venture capital will still flow to innovative ideas.

- Regulatory landscape: Increased scrutiny on Big Tech could reshape the competitive environment.

Investors should keep an eye on emerging technologies and their potential to disrupt traditional industries.

Manufacturing: Reshoring Trends and Challenges

The push to bring manufacturing back to US soil continues, with both opportunities and hurdles:

- Automation adoption: Increased use of robotics and AI in manufacturing processes

- Workforce development: Need for upskilling and reskilling programs to meet new job requirements

- Supply chain resilience: Ongoing efforts to diversify and strengthen supply networks

US manufacturers will need to balance the benefits of reshoring with the challenges of higher labor costs and regulatory requirements.

Potential Economic Curveballs for 2024

While economic forecasts provide a general direction, unexpected events can quickly change the landscape. Some potential curveballs to watch out for:

- Geopolitical tensions leading to trade disruptions

- Severe weather events impacting agriculture and infrastructure

- Technological breakthroughs disrupting established industries

- Cybersecurity threats to critical economic systems

Businesses and individuals should maintain flexibility in their financial planning to adapt to unforeseen circumstances.

Consumer Outlook for 2024

Consumer behavior will play a crucial role in shaping the 2024 economy. Key trends to watch:

- Shift towards experiences: Post-pandemic, consumers are likely to prioritize travel and entertainment.

- Sustainable consumption: Growing preference for eco-friendly and socially responsible products.

- Digital-first mindset: Continued growth in e-commerce and digital services.

Businesses that align with these consumer trends are likely to see stronger growth in the coming year.

Business Landscape in 2024

The business environment in 2024 will be characterized by rapid change and adaptation:

- Small business resilience: Focus on niche markets and personalized services

- Corporate innovation: Increased investment in R&D and digital transformation

- Workplace evolution: Continued refinement of hybrid and remote work models

Successful businesses will be those that can quickly adapt to changing market conditions and consumer preferences.

The Fed’s Tightrope Walk in 2024

The Federal Reserve will continue its delicate balancing act in 2024:

- Interest rates: Potential for small adjustments based on economic indicators

- Inflation control: Vigilant monitoring to prevent price instability

- Growth support: Careful calibration to maintain economic momentum

Market participants should pay close attention to Fed communications for insights into future policy directions.

Global Economic Factors Influencing the US in 2024

The US economy doesn’t exist in isolation. Global factors will play a significant role:

- China’s economic performance: As a major trading partner, China’s growth will impact US businesses.

- Emerging market dynamics: Countries like India and Brazil could offer new opportunities and challenges.

- Global trade agreements: Evolving trade relationships will shape import/export dynamics.

US businesses should diversify their international strategies to mitigate risks and capitalize on global opportunities. 2023 Recession Avoided: What Lies Ahead for the US in 2024?

Strategies for Thriving in the 2024 Economy

To navigate the economic landscape of 2024, consider these strategies:

- Diversify investments: Spread risk across various asset classes and sectors.

- Embrace lifelong learning: Continuously update skills to remain competitive in the job market.

- Build emergency savings: Prepare for unexpected economic shifts or personal financial challenges.

- Stay informed: Regularly follow reputable economic news sources and analyses.

- Seek professional advice: Consult with financial advisors for personalized strategies.

By staying proactive and informed, individuals and businesses can position themselves for success in the dynamic economy of 2024.

Conclusion

In conclusion, while the US has successfully avoided a recession in 2023, the economic path ahead in 2024 is filled with both opportunities and challenges. By understanding the key trends and remaining adaptable, Americans can navigate the evolving economic landscape with confidence. Remember, economic forecasts are guides, not guarantees – stay vigilant, stay informed, and be prepared to adjust your strategies as needed.