Are you ready to take control of your money without breaking the bank? You’re in luck! The world of free personal finance software is booming, and it’s time you got in on the action. These digital tools are like having a financial wizard in your pocket, ready to help you budget, save, and grow your wealth – all without costing you a dime. Let’s dive into the treasure trove of free financial tools that’ll have you managing your money like a pro in no time! Top Free Personal Finance Software: Unlock Your Financial Potential.

Key Takeaways:

- Free personal finance software can revolutionize your budgeting and expense tracking

- No-cost tools offer powerful features for debt management and reduction

- Gratis apps provide savings optimization and investment guidance

- These platforms can help you set and achieve financial goals

- Using free software can significantly boost your overall financial health

Exploring the Advantages of Free Personal Finance Software

Gone are the days when managing your money meant drowning in spreadsheets or shelling out big bucks for fancy software. Today’s free personal finance tools are like Swiss Army knives for your wallet – they do it all, and they do it well.

But why should you jump on the free finance software bandwagon? Here’s the scoop:

- Cost-effective: Obviously, it’s free! You’re saving money while learning to save money.

- Accessible: Use these tools anytime, anywhere – on your computer, tablet, or smartphone.

- User-friendly: Most are designed with the average Joe in mind, not financial whizzes.

- Comprehensive: Many free tools offer features that rival paid versions.

- Customizable: Tailor the software to fit your unique financial situation and goals.

Think of free personal finance software as your own financial fitness tracker. Just like a step counter helps you reach your health goals, these tools keep your finances in tip-top shape. They’ll have you flexing those financial muscles in no time!

How Free Software Can Simplify Budgeting and Expense Tracking

Streamlining Monthly Budgeting

Remember when budgeting meant a date with a calculator and a headache? Those days are history! Free personal finance software turns budgeting from a chore into a breeze. It’s like having a money-savvy buddy right in your pocket. Top Free Personal Finance Software: Unlock Your Financial Potential.

Here’s how these digital dynamos make budgeting a walk in the park:

- Automated categorization: The software sorts your expenses faster than you can say “Where did my money go?”

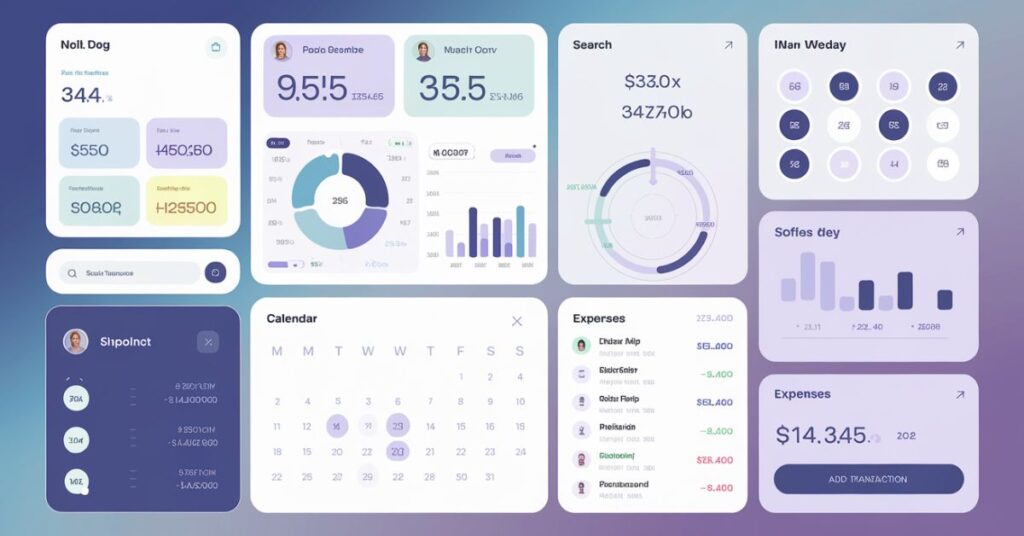

- Visual representations: Pie charts and graphs make your spending patterns crystal clear.

- Customizable categories: Whether you’re a latte lover or a gym rat, you can track what matters to you.

- Goal setting: Set savings targets and watch your progress in real time.

- Bill reminders: Never miss a due date again – your app’s got your back!

Take Sarah, for example. She used to avoid budgeting like the plague. But after trying a free budgeting app, she’s singing a different tune. “It’s like having a personal financial advisor, minus the hefty fees,” she says. “I finally feel in control of my money, not the other way around.”

Related Post: Top Free Personal Finance Software: Unlock Your Financial Potential

Real-Time Expense Tracking

Ever feel like your money’s pulling a disappearing act? Free finance apps are like GPS for your cash. They track your spending in real time, giving you a bird’s-eye view of where every penny goes.

Check out these game-changing features:

- Instant notifications: Get alerted the moment you make a purchase.

- Bank syncing: Your transactions appear automatically – no manual entry required.

- Receipt scanning: Snap a pic of your receipt and let the app do the rest.

- Spending trends: Spot patterns in your spending over time.

- Custom alerts: Set up warnings when you’re nearing your budget limits.

It’s like having x-ray vision for your wallet. You’ll spot those sneaky subscriptions and impulse buys before they can do any real damage to your bottom line.

Best Free Personal Finance Software for Money Management

Now, let’s cut to the chase. Here’s the cream of the crop when it comes to free personal finance software:

- Mint: The jack-of-all-trades in the finance app world. It does it all – budgeting, bill tracking, credit score monitoring. It’s like having a personal CFO in your pocket.

- Personal Capital: This one’s for the investment savvy. It’s got top-notch portfolio analysis tools that’ll make you feel like a Wall Street whiz.

- EveryDollar: Dave Ramsey fans, rejoice! This app brings his zero-based budgeting to life. It’s like having Dave cheering you on from your smartphone.

- GnuCash: Open-source and proud of it. This desktop software is perfect for small business owners or those who like their finances with a side of customization.

- Goodbudget: Bringing the envelope system into the digital age. It’s like having a virtual piggy bank for every expense. Top Free Personal Finance Software: Unlock Your Financial Potential.

Let’s break down these top contenders:

| Software | Best For | Standout Feature |

|---|---|---|

| Mint | All-around use | Comprehensive budgeting tools |

| Personal Capital | Investors | Investment checkup |

| EveryDollar | Debt payoff | Zero-based budgeting |

| GnuCash | Small businesses | Double-entry accounting |

| Goodbudget | Cash envelope fans | Digital envelope system |

Remember, the best software is the one you’ll use. It’s like finding the perfect workout routine – it needs to fit your lifestyle and goals to be effective.

Debt Management and Reduction with No-Cost Fiscal Tools

Analyzing Debt with Digital Solutions

Debt can feel like a monster under the bed, but with free personal finance software, you’ve got a debt-busting flashlight. These tools help you face your financial fears head-on.

Here’s how they shine a light on your debt situation:

- Debt overview: See all your debts in one place, no more hiding from the numbers.

- Interest rate comparisons: Spot those high-interest culprits at a glance.

- Payoff projections: See the light at the end of the tunnel with payoff date estimates.

- What-if scenarios: Play around with different payoff strategies to find your best path.

It’s like having a financial therapist, helping you confront and conquer your debt demons. No judgment, just clear, actionable insights. Top Free Personal Finance Software: Unlock Your Financial Potential.

Strategies for Effective Debt Payoff

Armed with insights from your free software, you’re ready to tackle debt like a pro. These tools often come with built-in strategies to supercharge your debt payoff:

- Debt snowball method: Knock out smaller debts first for quick wins and motivation.

- Debt avalanche approach: Target high-interest debts to save more in the long run.

- Debt consolidation analysis: See if consolidating your debts could save you money.

- Extra payment calculator: Find out how much time and money you’ll save by paying extra.

Take Tom’s story, for instance. He was drowning in credit card debt until he started using a free debt payoff tool. “It was like having a personal coach,” he says. “The app showed me exactly where to focus my efforts, and I paid off $15,000 in just 18 months!”

With these strategies, you’re not just paying off debt; you’re outsmarting it. It’s like playing chess with your finances and always being three moves ahead.

Savings Optimizer and Investment Aid Features in Financial Apps

Automated Savings Calculation

Saving money shouldn’t feel like pulling teeth. Free personal finance software makes it as easy as pie. These clever tools analyze your income and spending patterns to suggest optimal savings amounts.

Check out these savvy savings features:

- Smart saving suggestions: The app might say, “Hey, you can totally stash an extra $50 this month without feeling the pinch!”

- Round-up savings: Automatically round up purchases and save the difference.

- Savings goals: Set targets for big purchases or emergency funds and track your progress.

- Savings accounts comparison: Find the best interest rates for your hard-earned cash.

It’s like having a savvy friend who always knows where you can find spare change in your financial couch cushions. Before you know it, you’ll have a nice little nest egg growing!

Investment Portfolio Suggestions

Think you need a fat bank account to start investing? Think again! Many free finance apps now offer investment insights that used to be reserved for the wealthy.

Here’s how these tools can turn you into a savvy investor:

- Risk tolerance assessment: Find out if you’re more tortoise or hare when it comes to investing.

- Diversification analysis: See if your eggs are in too few baskets.

- Fee analyzer: Uncover hidden fees that might be eating into your returns.

- Retirement planning: Get a clear picture of your progress towards retirement goals.

It’s like having a mini Warren Buffett in your phone, minus the Berkshire Hathaway price tag. You’ll be talking about ETFs and asset allocation like a pro in no time. Top Free Personal Finance Software: Unlock Your Financial Potential.

Integrating Wealth Growth Strategies with Personal Finance Platforms

Setting and Achieving Financial Goals

Free personal finance software isn’t just about tracking pennies; it’s about making dollars grow. These platforms help you set SMART financial goals:

- Specific: “Save $5,000 for a vacation” beats “Save more money”

- Measurable: Track progress with visual aids and notifications

- Achievable: The software helps break big goals into bite-sized chunks

- Relevant: Align your goals with your values and lifestyle

- Time-bound: Set deadlines to keep yourself accountable

It’s like having a personal trainer for your money, pushing you to flex those financial muscles and reach new heights. Whether you’re saving for a down payment on a house or building your emergency fund, these tools keep you on track and motivated.

Maximizing Wealth Growth Opportunities

With your goals set, these free tools become your wealth-building sidekick. They can help you:

- Identify investment opportunities: Spot areas where you can redirect funds to grow your wealth.

- Optimize retirement contributions: See the impact of increasing your 401(k) or IRA contributions.

- Explore passive income: Learn about dividend stocks or real estate investment trusts (REITs).

- Understand compound interest: Visualize the magic of compound interest over time.

Take Lisa’s case. She never thought she’d be an investor until her free finance app showed her the potential. “I started with just $50 a month in a low-cost index fund,” she shares. “Five years later, I’ve got a diverse portfolio and I’m on track for early retirement!”

It’s like having a crystal ball that shows you the potential future of your finances. The best part? You’re in control of making that future a reality.

Conclusion

Free personal finance software is like a Swiss Army knife for your wallet. It slices through confusion, dices expenses, and helps you carve out a path to financial freedom. From budgeting breakthroughs to investment insights, these tools pack a powerful punch without costing you a cent.

Remember, the journey to financial success is a marathon, not a sprint. These free tools are your water stations along the way, keeping you hydrated and energized for the long haul. So why wait? Download a few, try them out, and find the one that fits you best. Your future self (and your wallet) will thank you!

FAQ

Q: Is free personal finance software really as good as paid versions?

A: Often, yes! Many free options offer features that rival paid software. The key is finding one that fits your needs. While paid versions might offer more advanced features or customer support, free versions often provide all the tools necessary for effective personal finance management.

Q: How secure is my financial data with these free apps?

A: Reputable free finance apps use bank-level encryption to protect your data. Always check their security measures and read user agreements. Look for features like two-factor authentication and read up on the company’s data protection policies. Remember, no online service is 100% secure, so always practice good digital hygiene.

Q: Can I use multiple free finance apps together?

A: Absolutely! Many users mix and match to leverage the best features of each app. For example, you might use one app for budgeting and another for investment tracking. Just be sure to keep your information consistent across platforms.

Q: Do I need to be tech-savvy to use these tools?

A: Not at all! Most are designed with user-friendliness in mind. If you can use a smartphone, you can master these apps. Many offer tutorials or help centers if you get stuck. Remember, it’s okay to start slow and learn as you go.

Q: Will these apps help me with taxes?

A: Some offer basic tax insights, but for complex tax situations, you might need specialized software or professional help. However, many of these apps can make tax time easier by keeping your financial information organized throughout the year.