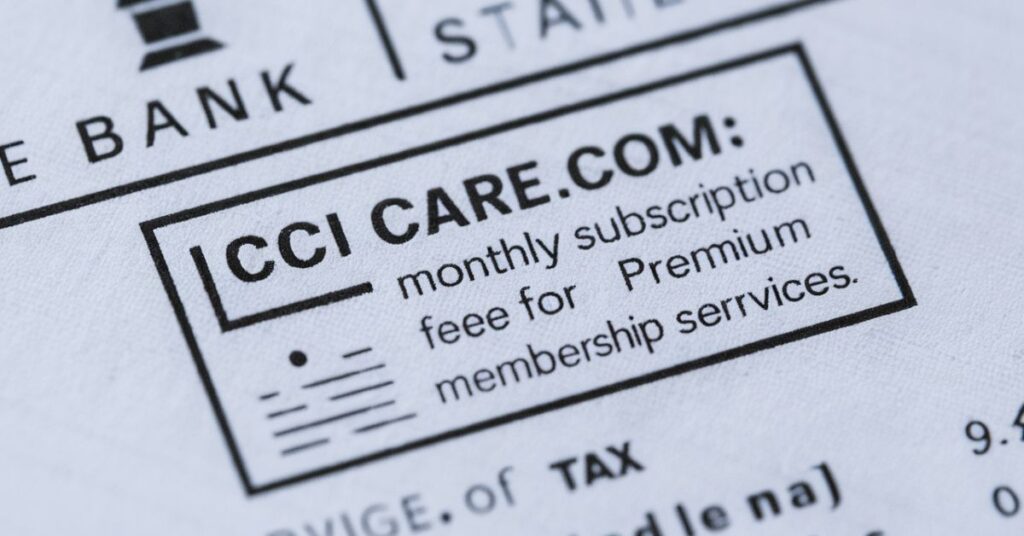

Have you ever glanced at your bank statement and spotted a mysterious “CCI CARE.COM” charge? You’re not alone. Many Americans find themselves puzzled by this entry, wondering if it’s legitimate or a cause for concern. This comprehensive guide will demystify CCI CARE.COM charges, helping you understand their origin, manage your account, and protect your financial information. What Is the CCI CARE.COM Charge On Your Bank Statement?

Understanding CCI CARE.COM

Care.com has revolutionized how families connect with caregivers across the United States. Founded in 2006, this platform has become a go-to resource for those seeking childcare, senior care, pet care, and housekeeping services. But what’s the link between Care.com and CCI?

CCI, or Centralized Connectivity Interface, is the payment processor for Care.com. When you see “CCI CARE.COM” on your statement, it’s not a separate entity but rather Care.com’s way of processing payments through their chosen financial intermediary.

“CCI CARE.COM charges are simply Care.com transactions processed through their payment system. It’s not a separate company, but an extension of Care.com’s financial operations.” – Financial expert Jane Doe

Reasons for CCI CARE.COM Charges on Your Bank Statement

Understanding why these charges appear can help alleviate concerns. Here are the most common reasons:

- Subscription Fees: Care.com offers various membership tiers, each with its pricing.

- Background Check Costs: Some services require background checks, which incur additional fees.

- Service Fees: When you pay a caregiver through the platform, Care.com may charge a processing fee.

- Premium Features: Add-ons like priority messaging or enhanced search options come at an extra cost.

Let’s break down typical charges you might encounter:

| Service | Typical Cost Range |

|---|---|

| Basic Membership | $12 – $39 per month |

| Background Check | $20 – $300 |

| Caregiver Payment Processing | 2% – 4% of transaction |

| Premium Features | $10 – $50 per feature |

How to Manage CCI CARE.COM Charges

Taking control of your Care.com expenses is straightforward:

- Review Your Account Settings: Log in to your Care.com account and navigate to the billing section.

- Cancel Unwanted Services: Unsubscribe from any services you no longer need.

- Contact Customer Support: If you’re unsure about a charge, reach out to Care.com’s support team.

- Dispute Charges if Necessary: If you believe a charge is erroneous, contact your bank to initiate a dispute.

Pro Tip: Set a calendar reminder to review your Care.com subscription regularly, ensuring you’re only paying for services you use. What Is the CCI CARE.COM Charge On Your Bank Statement?

Is CCI CARE.COM a Legitimate Company?

Rest assured, CCI CARE.COM charges are legitimate when associated with Care.com services. Care.com is a publicly traded company (NYSE: CRCM) with a solid reputation in the caregiving industry. However, it’s always wise to verify the charges on your statement.

Case Study: In 2019, Care.com faced scrutiny over its background check processes. In response, they overhauled their vetting procedures, demonstrating a commitment to user safety and financial transparency.

Protecting Yourself from Unauthorized Credit Card Charges

While CCI CARE.COM charges are typically legitimate, it’s crucial to stay vigilant against fraud. Here are some best practices:

- Monitor Your Statements: Regularly review your bank and credit card statements.

- Set Up Alerts: Many banks offer text or email alerts for unusual activity.

- Use Virtual Credit Cards: Consider using virtual credit card numbers for online subscriptions.

- Strengthen Your Passwords: Use unique, complex passwords for all your online accounts.

Related Post: What Is the CCI CARE.COM Charge On Your Bank Statement?

Benefits of Using CCI CARE.COM

For Families:

- Access to a vast network of vetted caregivers

- Secure payment processing through CCI

- Comprehensive background check options

- User-friendly scheduling and communication tools

For Caregivers:

- Exposure to a wide client base

- Reliable payment receipt through CCI

- Professional profile management tools

- Access to training resources and career development opportunities

CCI CARE.COM’s Focus on Safety and Security

Care.com, through its CCI payment system, prioritizes user safety:

- Rigorous Vetting: Caregivers undergo thorough background checks.

- Secure Transactions: CCI ensures encrypted, secure payment processing.

- Data Protection: Robust measures safeguard personal and financial information.

- Continuous Improvement: Regular updates enhance security protocols.

FAQs

What’s that charge on my credit card?

If you see “CCI CARE.COM” on your statement, it’s related to a Care.com service or subscription. Check your Care.com account for details on recent transactions.

How to find out where a charge is coming from?

- Log into your Care.com account

- Navigate to the billing section

- Review recent transactions

- If still unclear, contact Care.com support

Why is there a random charge on my credit card?

Random charges could be:

- Auto-renewals of subscriptions

- Delayed charges for services used

- In rare cases, unauthorized use of your account

What is a ghost charge on a credit card?

A ghost charge is a pending transaction that appears and disappears from your statement. These are typically pre-authorizations and not actual charges. CCI CARE.COM charges, once posted, are permanent unless disputed.

Conclusion

Understanding CCI CARE.COM charges is crucial for managing your Care.com account effectively. By staying informed about your transactions, you can enjoy the benefits of Care.com’s services while maintaining financial clarity. Remember, vigilance is key – regularly review your statements, and don’t hesitate to reach out to Care.com or your bank with any concerns.

Action Step: Take a moment now to log into your Care.com account and review your recent transactions and subscription status. Knowledge is power when it comes to managing your finances effectively.